Portfolio Bet Result Update 9th April

- Ryan Phillips

- Apr 9, 2024

- 6 min read

Portfolio Bet will be ready to launch this week, either Thursday or Friday.

Everyone registered will receive an exclusive invite containing an extra 17% discount on the annual membership.

An email will be sent ahead of launch, so keep an eye on your inbox.

This will contain a link and password to access the two subscription options, quarterly or yearly.

If you haven't registered your interest, and you would like to receive an invitation to join, please visit https://www.portfoliobet.co.uk/

Simply click on Notify Me, and enter your email address.

I will then be in touch with your invite to join later this week, with the extra discount included.

In today's post I have the complete result spreadsheet for Portfolio Bet.

Both for exchange straight minutes to post direct to the exchange, and for Betfair Starting Price (BSP).

The results shown here today, and within the spreadsheet you can download, these are the final version of each strategy.

They are exactly what each Portfolio Bet member will have in operation betting for them using the automation written into the software.

The results demonstrate a long spread of betting data that covers both live betting, and is drawn from the software I used to create the four automated bet systems.

I will go over exactly how I create automated strategies in a post coming up next week.

I'll demonstrate how I work with the tools custom made for Exponential Bet and Portfolio Bet by Nigel Dove.

The data used is all filtered through our own set of filters, and I have my own criteria for specific triggers, which can be singled out, filtered, and built upon to create strategic layers of betting styles that combine to become long term bet investments.

There is nothing available online that works in the same way as our bespoke Researcher tool. It's been designed from the ground up to create betting strategies that can be directly transferred to be used with automation.

The race data itself and its parameters come from the results we accumulate over time, and from specific in play data we acquired, and can interpret that however we decide.

More to come on this, as I think it will be good to pull back the curtain a little and show anyone that is interested how I crunch data to create automated bet strategies.

Now for today's Portfolio Bet update which I will publish this in two parts.

In this blog post I am simply going to upload the spreadsheet and explain the tabs, and give you a complete overview screenshot for MTP and BSP betting.

Then on Thursday, or tomorrow if I have time in the morning, I will go into more detail about each strategy, and how it operates in conjunction with each other to create the Portfolio Bet service.

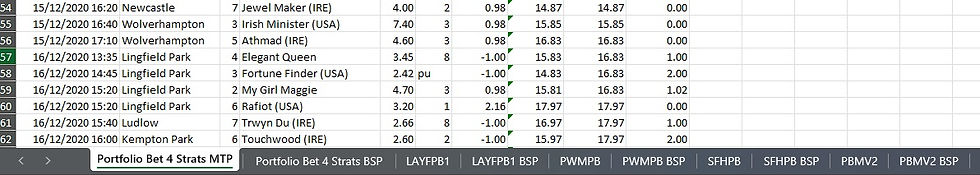

Here is a snapshot of the tabs you will find within the sheet you can download near the base of this post.

The first two tabs, Portfolio Bet 4 Strats MTP show all four strategies running concurrently over the timeline, but betting using Exchange Straight within the software.

This means of course results will vary given that bets are fired to a live betting exchange, but as it's all win market betting with no place betting, the variance will be a lot closer to the published results due to it being a much more liquid market.

The next tab to the right of this is Portfolio Bet 4 Strats BSP, which are the exact same bets placed as MTP, but with Betfair Starting Price (BSP) selected within the software, so you will see the BSP odds achieved on this tab.

What this means is, all the lay bets go on at fixed liability, which is how Betfair works it, but all the back bets go on as normal using the fixed stake set within the bot.

You will find the overall profit for fixed liability bets, when examining the BSP tabs for each strategy, which is a lot less than exchange straight MTP betting, but when combined with fixed stake back bets within the portfolio, the overall drawdown is very similar given the return for the fixed liability bets is less.

The pros for BSP are plenty, but the obvious one is that published results match your own, and you will have no issue being matched for your desired stake amount.

The biggest con for BSP is fixed liability has to be used for lay betting with Betfair.

The pros for MTP is that overall it shows a higher profit threshold can be achievable.

The cons for using MTP is that overall the reported profit at minutes to post, when the bets go on, will vary to your own, and it's likely you will not achieve the same profit over time, or have more loss on some bets that have higher odds on the lay for example.

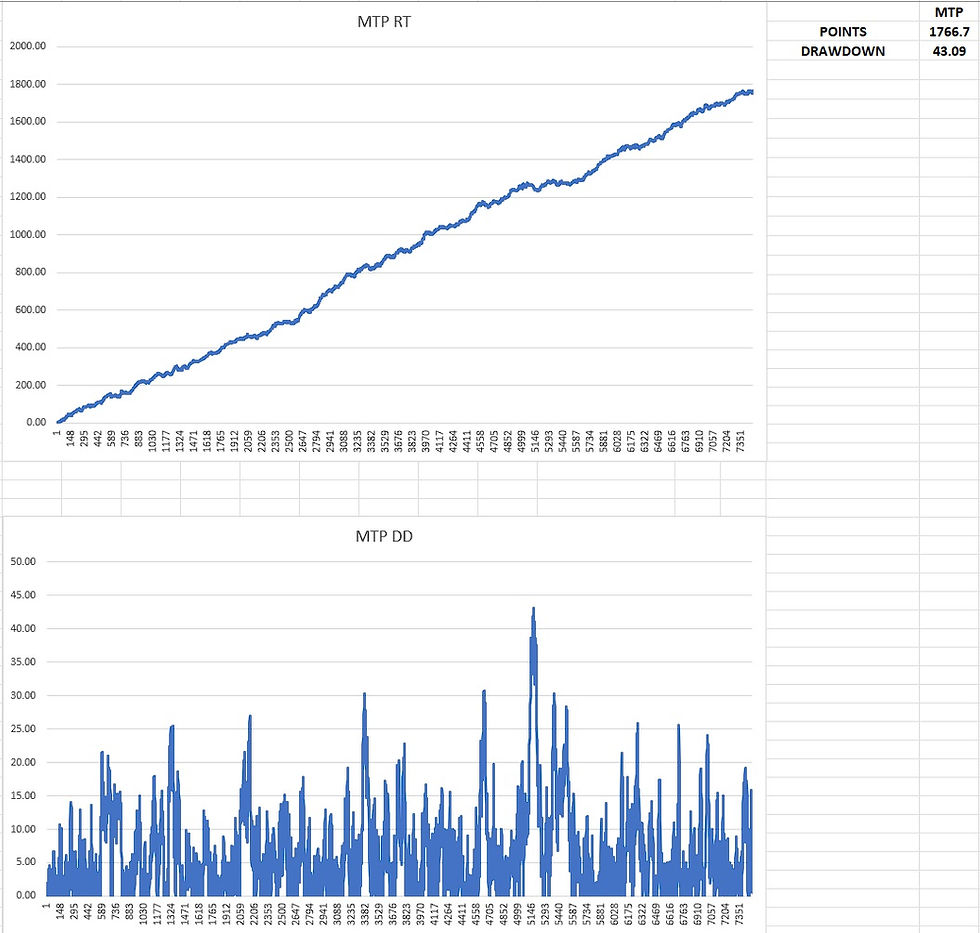

However, given the profit for Portfolio Bet results come in so strong and show a consistent upward growth over time, and with a very acceptable drawdown, my assessment is that I predict BSP and Exchange Straight will be very closely matched when it comes to individual betting returns.

The overall drawdown across the 40 month period is also very comfortable for a working 200 point investment, but you can use more or less within the software, this is fully in your control. What I have done which is previously explained in another post, is to show the required recommended investment start up if entering a stake amount within the software, or the stake amount if entering your investment amount.

Now back to the excel sheet and to wrap up today's post with the data you want to see.

The remaining tabs to the right of the two overview tabs explained above for MTP and BSP, these are the individual strategy results for MTP and BSP.

You will find the MTP version, then next to it the BSP version.

There are two laying strategies and two backing to make up the four included strategies for Portfolio Bet.

The names on the tabs for the strategies are for my reference purpose, so pay no attention to them, but you can see the first two are laying, and the second two are the back strategies when examining each set of results.

As mentioned above, I will go into more detail with the individual strategies ideally tomorrow, but if not on Thursday before I give the site and software a final quality check before we go live.

Here are the Portfolio Bet result overviews for MTP Exchange Straight & BSP, with the downloadable spreadsheet available below at the base of the post.

Delve into each strategy to see how they compliment each other when in operation concurrently.

The average annual profit for MTP comes in at 530 points, with BSP currently at 384.55 points profit.

Allowing for variance, and that actually you can see for yourself when looking at each of the strategies, BSP is very close to MTP in some instances, my projection is they will both return an average annual points profit somewhere between 350 to 400 per annum.

Anywhere above 300 points per annum as an average is excellent, but I expect them to do better over the years looking at the numbers unfold.

We can expect some years to be better than others of course, but these strategies are all set up as long term bet investments, which is why I have tried to make them so accessible from a membership fee perspective.

Virtually anyone can join and spend the next three, five, or ten years building up a decent portfolio.

Looking at the data from the live betting and Researcher tool numbers, we have an exceptional opportunity to set this up to do very well for all of us. The fact it works solely in the Betfair win market is a definite plus.

The allotted 200 points per annum start up should carry the betting comfortably, allowing for periods shown when we will see losing spells that need to be carried.

Allowing for this with the right balance that sits right with you is absolutely vital, you need to consider your own comfort zone, or follow my advised 200 start up, which should give plenty in the tank to weather the inevitable losing periods.

The lowest recorded point showing at -48.69 betting with BSP, but virtually the same level for MTP with -43.09.

When factoring in variance with direct to the exchange betting, it may be the reverse result over time for MTP and BSP drawdown in fact.

Okay, that's me for today with result assessment, as I just wanted to get this out there to show how I have taken a lot of care to selected four strategies to work together to create Portfolio Bet. I want these to do as predicted, with the goal to enjoy fantastic returns for many years to come.

I'll be back tomorrow or Thursday to follow up this result blog post, and to confirm the Portfolio Bet launch.

If you have any questions about today's post, or anything to do with Portfolio Bet, please let me know, and I will do my best to come back to you asap within 24 hours.

#bsp #betfairstartingprice #betfairexchange #bettingexchange #makemoney #investing #investor #betfairtrader #bettingexpert #betbot #bettingsoftware #backtolay #laytoback #workathome #laying #backing #dutching #trading #trade #bettingsystem

Comments